How Do I Calculate My Net Income In Canada

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. At 80000 you will also have income in the lower two tax brackets.

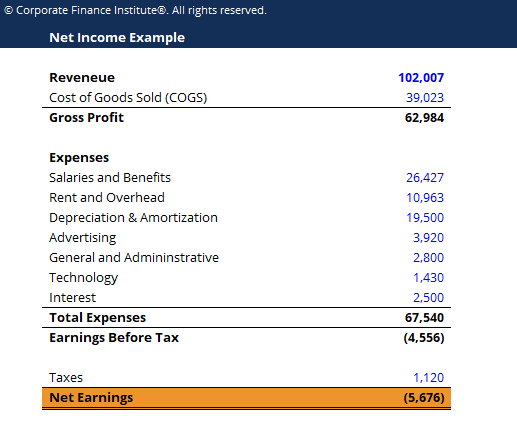

Calculating A Company S Net Income And Why It Matters The Motley Fool

Below there is simple income tax calculator for every Canadian province and territory.

How do i calculate my net income in canada. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Like the name implies total income refers to income that is. Curious to know your gross employment income net pay deducted tax CPPEI.

This means that high-income residents pay a higher percentage than low-income residents. There are two ways to determine your yearly net income. The Canadian Retirement Income Calculator will provide you with retirement income information.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec. That means that your net pay will be 40568 per year or 3381 per month.

Some money from your salary goes to a pension savings account insurance and other taxes. Your average tax rate is 220 and your marginal tax rate is 353. Annual net income calculator.

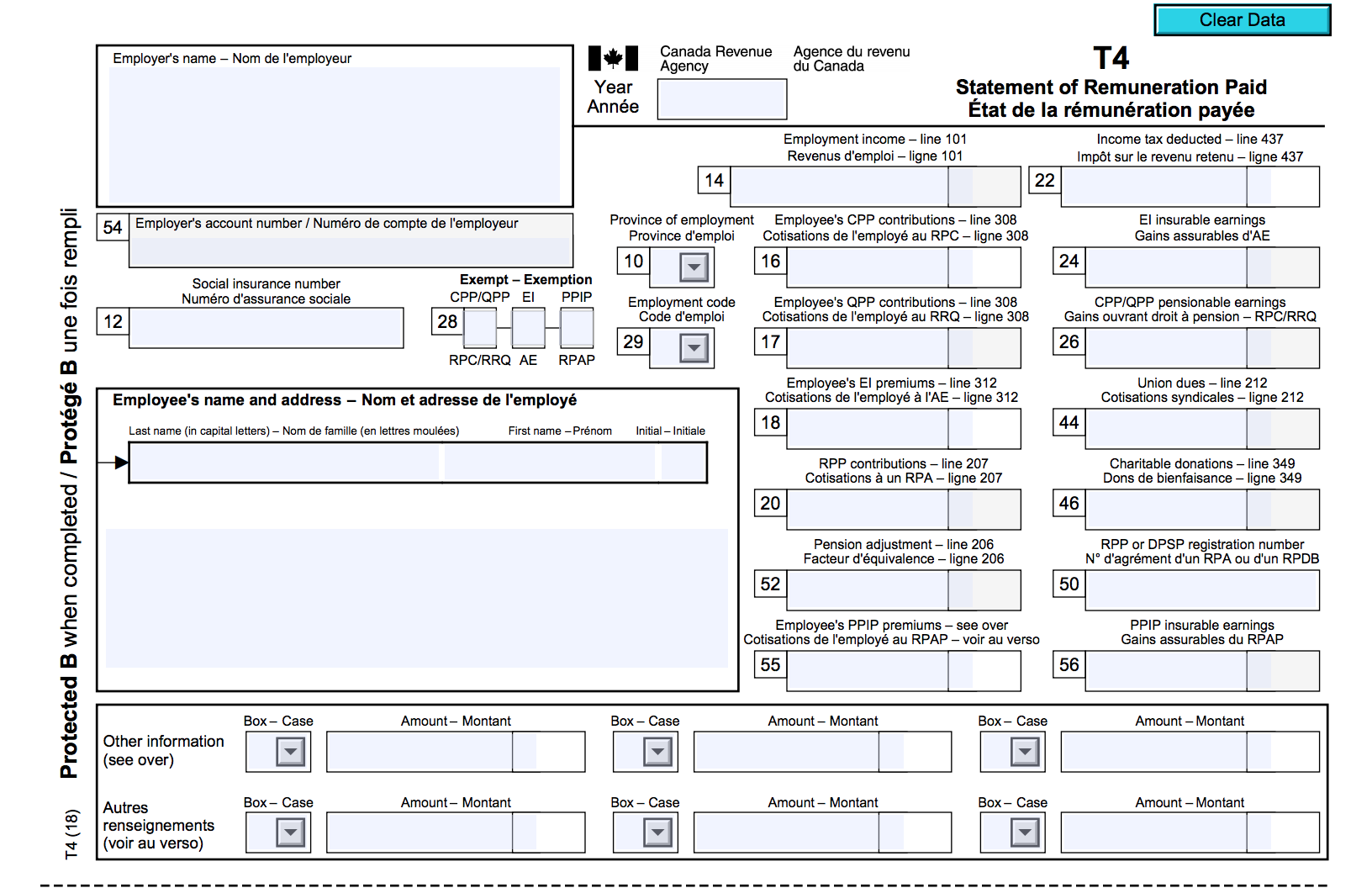

Available Tax Forms All-in-one data center Checklist T4 T4A T4AOAS T4AP T4E T4PS T4A-RCA T4RIF T4RSP T5 T3 T5007 T5008 T5013 T1 GENERAL ON428 Show more forms. Any income beyond the upper limit will be taxed at the next tax bracket rate of 26. Pay 205 on the amount between 48535 to 97069 or 30033.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Pay 15 on the amount up to 48535 or 728025.

The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. This is how the calculation looks at Step 5 of Canada Revenue Agency fillablesaveable Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada. Total federal tax payable.

You will then need to compare them to your goal income. Its used to determine your federal and provincial or territorial non-refundable credits or any social benefits you receive like the GSTHST credit or the Canada child benefit. In Canada each province and territory has its own provincial income tax rates besides federal tax rates.

0 to 13229 and 13230 - 49020. Calculate your salary after tax by province compare salary after tax in different provinces with full income tax rates and thresholds for 2021. Calculate Canadian Tax Brackets.

The CRA also uses your net income and if you are married or living common-law your spouse or common-law partners net income to calculate amounts such as the Canada child benefit the GSTHST credit the social benefits repayment and certain credits. The calculator is updated with the tax rates of all Canadian provinces and territories. This is required information only if you selected the hourly salary option.

This includes the Old Age Security OAS pension and Canada Pension Plan CPP retirement benefits. Online salary calculator for each province in Canada. Your net income is calculated by subtracting all allowable deductions from your total income for the year.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Youll get a rough estimate of how much youll get back or what youll owe. It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures.

Set the net hourly rate in the net salary section. Your income within those brackets 13229 and 35791 will be taxed at their respective tax rates of 0 and 15. Gross annual income Taxes Surtax CPP EI Net annual salary Net annual salary Weeks of work.

Enter the number of hours worked a week. Or you can choose tax calculator for particular province or. The amount can be hourly daily weekly monthly or even annual earnings.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Use our simple 2020 income tax calculator for an idea of what your return will look like this year.

For example a salary of 100000 in Alberta puts you in the 85th percentile of wage earners in the province whereas the same salary in Ontario puts you in the 90th percentile and in the Northwest Territories in the 75th percentile. Net income is used to calculate federal and provincial or territorial non-refundable tax credits. Net income is the money after taxation.

Enter your household income not individual income in Canadian dollars select your province and the household income percentile calculator will let you know where you stand in regards to percentile compared to other Canadian households. Tax Bracket Federal. Your taxable income puts you in the following brackets.

To estimate your retirement incomes from various sources you will need to work through a series of modules. It also allows you to see the. Enter your pay rate.

One of a suite of free online calculators provided by the team at iCalculator. Canada income tax calculator - calculate tax CPPEI and pay-up date etc of the employment income. The Payroll Deductions Tables help you calculate the Canada Pension Plan CPP.

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

The Canadian Employer S Guide To The T4 Bench Accounting

Income Tax Formula Excel University

How To Calculate Net Income 12 Steps With Pictures Wikihow

Need To Make Extra Money Check Out These Side Jobs Net Income Income Extra Money

How To Calculate Net Income 12 Steps With Pictures Wikihow

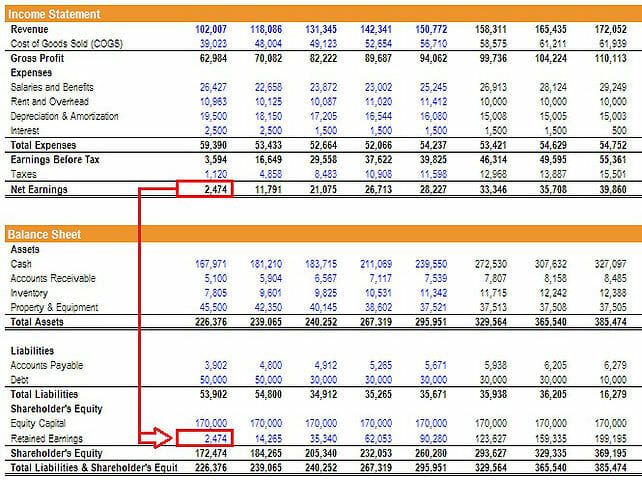

Net Income Template Download Free Excel Template

How To Calculate Net Income 12 Steps With Pictures Wikihow

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Net Income The Profit Of A Business After Deducting Expenses

Income Tax Formula Excel University

What Is Net Income H R Block Canada

Net Income The Profit Of A Business After Deducting Expenses

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Pre Tax Profit With Net Income And Tax Rate The Motley Fool

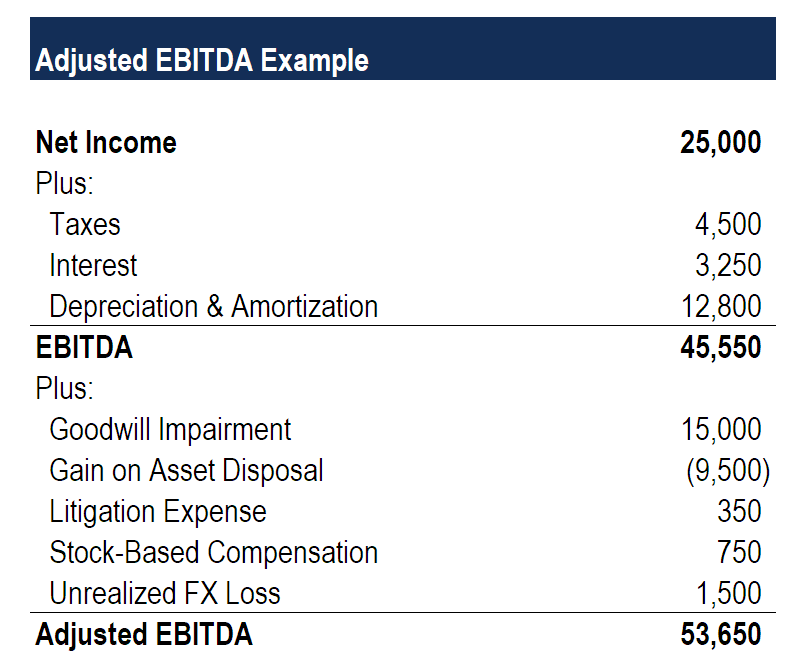

Adjusted Ebitda Overview How To Calculate Adjusted Ebitda

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "How Do I Calculate My Net Income In Canada"